Average Auto Insurance Quote by State in 2025 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. Exploring factors influencing rates, regional disparities, and future trends, this discussion delves into the intricate world of auto insurance pricing.

Average Auto Insurance Quote by State in 2025

Auto insurance rates can vary significantly depending on various factors, including the state in which you reside. These rates are influenced by a combination of state regulations, economic conditions, and individual driving records.

Factors Influencing Auto Insurance Rates

Several factors play a role in determining auto insurance rates, such as:

- The driver's age, gender, and driving history

- The type of vehicle being insured

- The frequency of accidents and thefts in the area

- The coverage options selected by the policyholder

State Regulations and Insurance Quotes

Insurance companies take into account state regulations when determining quotes for auto insurance. Each state has its own laws regarding minimum coverage requirements, which can impact the cost of insurance premiums. States with higher minimum coverage requirements tend to have higher insurance rates.

Impact of Economic Conditions on Insurance Pricing

Economic conditions, such as the overall cost of living, inflation rates, and unemployment levels, can also affect auto insurance pricing. In states with a higher cost of living, insurance rates may be more expensive to offset the increased expenses associated with repairs and medical care.

Regional Disparities in Auto Insurance Costs

When it comes to auto insurance costs, there are significant variations between states in the United States. These differences can be attributed to various factors that influence insurance pricing.

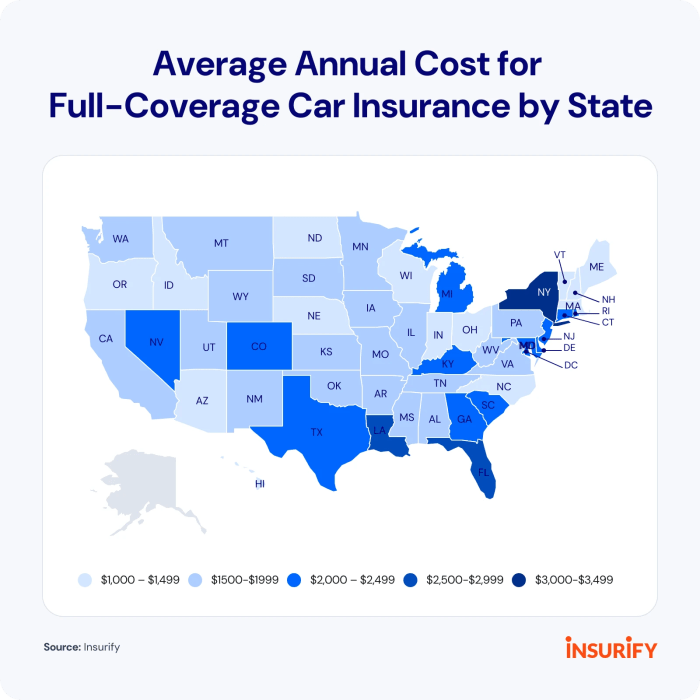

Average Insurance Costs by State

Insurance costs can vary greatly between states due to factors such as population density, crime rates, weather conditions, and state regulations. States with higher population densities or higher rates of car thefts and accidents tend to have higher insurance premiums.

- States like New York, Michigan, and Louisiana often have some of the highest average insurance costs in the country due to their dense urban populations and high crime rates.

- Conversely, states with lower population densities and fewer incidents of car theft and accidents, such as Vermont, Maine, and Iowa, tend to have lower insurance rates.

Factors Influencing Insurance Rates

Population density plays a significant role in determining insurance costs. States with higher population densities are more likely to have congested roads and a higher frequency of accidents, leading to increased insurance premiums to cover the higher risk.

Crime rates also impact insurance pricing, as states with higher rates of vehicle thefts and vandalism are considered riskier for insurers. This increased risk results in higher premiums for drivers in those states.

Future Trends in Auto Insurance Quotes

As we look ahead to 2025, several key trends are poised to shape the landscape of auto insurance pricing. Advancements in technology, changing consumer behaviors, and environmental factors are all expected to play a significant role in determining insurance costs.

Impact of Advancements in Technology

With the rise of autonomous vehicles, telematics, and usage-based insurance programs, insurers are likely to have more data at their disposal to assess risk accurately. This shift towards data-driven pricing models could lead to more personalized insurance quotes based on individual driving habits and patterns.

Environmental Factors and Insurance Premiums

Climate change and extreme weather events are becoming more frequent, leading to an increase in insurance claims related to natural disasters. As insurers face higher payouts due to these events, premiums may rise to cover the associated risks. Additionally, the push towards eco-friendly vehicles could result in discounts for drivers with electric cars or hybrid vehicles.

Regulatory Environment and Insurance Pricing

State regulations play a crucial role in determining auto insurance quotes. These regulations can vary significantly from state to state and can impact the pricing of insurance policies. Legislative changes and legal reforms can also have a direct influence on auto insurance costs.

Role of State Regulations

State regulations dictate the requirements and guidelines that insurance companies must follow when determining auto insurance quotes. These regulations can include factors such as minimum coverage levels, allowable discounts, and limitations on pricing strategies. States with more stringent regulations may see lower average insurance costs due to increased consumer protections.

Legislative Changes and Insurance Costs

Legislative changes at the state level can directly impact auto insurance pricing. For example, a state that implements new laws requiring higher minimum coverage levels may see an increase in insurance costs for drivers. Conversely, legislative changes that promote competition among insurance providers may lead to lower overall insurance premiums.

Impact of Legal Reforms

Legal reforms, such as tort reform or changes to the legal system governing insurance claims, can also affect auto insurance pricing. For instance, states that enact tort reform measures to limit the ability to file certain types of lawsuits may experience a decrease in insurance costs as a result of reduced claim payouts.

Conversely, legal reforms that expand consumer rights or increase the potential for large settlements may lead to higher insurance premiums for drivers.

Final Summary

In conclusion, Average Auto Insurance Quote by State in 2025 sheds light on the complex landscape of insurance pricing, revealing the dynamic interplay of regulations, economic conditions, and technological advancements. As we look ahead to 2025, the future of auto insurance quotes remains both challenging and intriguing, shaped by evolving factors that continue to influence the industry.

General Inquiries

What factors influence auto insurance rates?

Auto insurance rates are influenced by factors such as age, driving record, vehicle type, and coverage options.

How do insurance companies determine quotes based on state regulations?

Insurance companies consider state-specific regulations, including minimum coverage requirements, when calculating insurance quotes.

What role do economic conditions play in insurance pricing?

Economic conditions, such as inflation and unemployment rates, can impact insurance pricing by affecting overall risk and claims frequency.