Delving into the intricate world of auto insurance, this guide sheds light on the significant role age and location play in determining insurance quotes. Prepare to uncover valuable insights that could potentially impact your insurance decisions.

Factors that Influence Auto Insurance Quotes

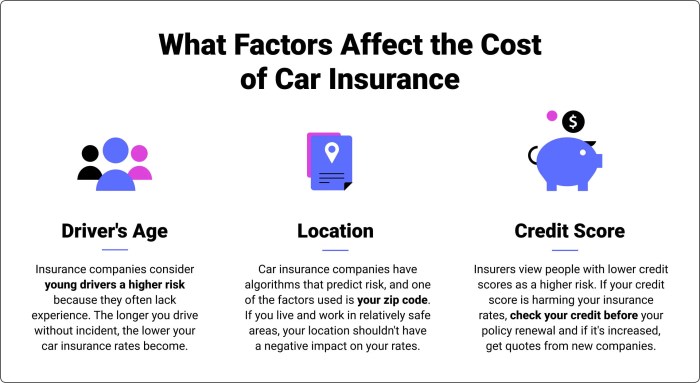

Age and location are critical factors that influence auto insurance quotes. Insurance companies take into account these factors when providing quotes because they directly impact the risk profile of the insured individual.

Age

Age plays a significant role in determining auto insurance rates. Younger drivers, especially teenagers, are often charged higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older drivers, typically above 25 years old, may benefit from lower rates as they are considered more experienced and responsible on the road.

Location

The location where a driver resides also affects auto insurance quotes. Urban areas with higher population densities tend to have more traffic congestion and a greater risk of accidents, leading to higher premiums. Additionally, areas prone to theft or vandalism may result in increased rates to cover potential losses.

Impact of Age on Auto Insurance Quotes

Age plays a significant role in determining auto insurance quotes, with rates varying for different age groups. Young drivers often face higher premiums compared to older, more experienced drivers. Let's explore the factors that contribute to this difference.

Youthful Drivers vs. Seasoned Drivers

Young drivers, typically those under the age of 25, are considered high-risk by insurance companies due to their lack of driving experience. This lack of experience increases the likelihood of accidents, leading to higher insurance premiums. On the other hand, older drivers, especially those above 50, are seen as safer drivers with more years of driving experience.

As a result, they often enjoy lower insurance rates.

- Young drivers may be charged higher premiums due to their higher accident rates.

- Older drivers with clean driving records may benefit from lower insurance rates.

- Insurance companies consider age as a risk factor when determining premiums.

Impact of Location on Auto Insurance Quotes

When it comes to auto insurance quotes, your location plays a significant role in determining the premiums you will pay. Insurers take into account various factors related to your location that can impact the likelihood of you filing a claim, ultimately affecting the cost of your insurance.

Urban vs. Rural Areas

Urban areas typically have higher insurance rates compared to rural areas. This is because urban areas tend to have higher population densities, more traffic congestion, increased incidents of theft and vandalism, and a higher risk of accidents. All of these factors contribute to a higher likelihood of insurance claims being filed, leading to higher premiums for drivers in urban areas.

Role of Zip Codes and Neighborhoods

Your zip code and neighborhood also play a crucial role in determining your insurance costs. Insurers analyze data specific to each zip code and neighborhood, including crime rates, accident statistics, and frequency of insurance claims

Statistical Data and Trends

In the realm of auto insurance, statistical data plays a crucial role in determining premium rates. Let's delve into the impact of age and location on auto insurance quotes based on trends and data.

Age and Auto Insurance Quotes

When it comes to age, statistical data shows that younger drivers tend to face higher insurance premiums compared to older drivers. This is primarily due to the fact that younger individuals are often deemed riskier drivers by insurance companies, as they have less driving experience and are more prone to accidents.

According to data from insurance providers, drivers under the age of 25 are considered high-risk and usually face higher premiums.On the other hand, older drivers, particularly those above the age of 50, may enjoy lower insurance rates due to their years of driving experience and typically safer driving habits.

Insurance companies view older drivers as less risky and therefore offer them more affordable premium rates.

Location and Auto Insurance Quotes

Geographical location also plays a significant role in determining auto insurance quotes. Urban areas with higher population densities and increased traffic congestion tend to have higher insurance premiums compared to rural areas. This is because urban areas are often associated with a greater risk of accidents, theft, and vandalism.Furthermore, certain states or regions may have specific trends in insurance pricing based on factors such as weather conditions, crime rates, and traffic laws.

For example, states prone to severe weather events like hurricanes or tornadoes may experience higher insurance rates due to the increased risk of vehicle damage.

Correlation between Age Demographics and Accident Rates

Statistical data reveals correlations between specific age demographics and accident rates in different regions. For instance, younger drivers are more likely to be involved in accidents compared to older drivers. This trend is reflected in insurance premiums, as younger age groups are charged higher rates to compensate for the increased risk of accidents.Similarly, certain geographical locations may have higher accident rates based on factors like road infrastructure, traffic patterns, and weather conditions.

Insurance companies analyze these trends to adjust premium rates accordingly, ensuring that drivers in high-risk areas pay appropriate insurance costs.

Last Point

In conclusion, understanding how age and location influence your auto insurance quote is crucial in making informed choices. By grasping the nuances of these factors, you can navigate the insurance landscape with confidence and clarity.

FAQ Resource

How does age affect auto insurance quotes?

Age is a significant factor in determining auto insurance rates. Generally, younger drivers tend to face higher premiums due to their perceived higher risk.

Why do insurance companies consider location when providing quotes?

Insurance companies take location into account as it can impact the likelihood of accidents or theft. Urban areas, for example, may have higher rates due to increased traffic and crime rates.

Are there specific age demographics that are more prone to accidents based on location?

Statistical data suggests that younger drivers in urban areas are more susceptible to accidents compared to older drivers in rural areas. This correlation influences insurance costs.