Top 10 Tips to Lower Your Auto Insurance Quote Fast sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a casual formal language style and brimming with originality from the outset.

Exploring factors impacting auto insurance rates, choosing the right coverage, seeking discounts and savings, understanding driving habits, shopping around for quotes, maintaining vehicle safety, managing credit scores, exploring usage-based insurance, reviewing coverage annually, and seeking professional advice are all part of the exciting journey ahead.

Factors Impacting Auto Insurance Rates

When it comes to auto insurance rates, several factors come into play that can significantly impact how much you pay for coverage. Understanding these factors and taking steps to improve them can help you lower your insurance costs.

Age

Your age is a key factor that insurance companies consider when determining your premium. Younger drivers, especially teenagers, are often charged higher rates due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older, more experienced drivers typically receive lower premiums.

Driving Record

Your driving record is another crucial factor. If you have a history of accidents or traffic violations, insurance companies may see you as a high-risk driver and charge you more for coverage. On the contrary, a clean driving record can lead to lower insurance quotes.

Vehicle Type

The type of vehicle you drive also plays a role in determining your insurance rates. Sports cars and luxury vehicles tend to have higher premiums due to their higher repair costs and increased likelihood of theft. On the other hand, safe and reliable vehicles typically come with lower insurance costs.

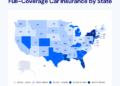

Location

Where you live can impact your insurance rates as well. Urban areas with higher traffic congestion and crime rates may result in higher premiums compared to rural areas. Additionally, regions prone to severe weather conditions or natural disasters may also lead to increased insurance costs.

Strategies for Lowering Insurance Costs

- Consider taking a defensive driving course to improve your driving skills and potentially qualify for discounts.

- Bundle your auto insurance with other policies, such as homeowners or renters insurance, to receive multi-policy discounts.

- Shop around and compare quotes from different insurance providers to find the best rates available.

- Increase your deductible to lower your premium, but make sure you can afford the out-of-pocket expense if you need to file a claim.

- Drive safely and avoid accidents and traffic violations to maintain a clean driving record and qualify for lower rates.

Choosing the Right Coverage

When it comes to auto insurance, selecting the right coverage is crucial in not only protecting your vehicle but also in lowering your insurance costs. Understanding the different types of coverage available and how they can impact your insurance quotes is key to finding the balance between adequate protection and affordability.

Types of Auto Insurance Coverage

- Liability Coverage: This is the most basic type of coverage that helps pay for damages or injuries you cause to others in an accident.

- Collision Coverage: This covers damage to your own vehicle in case of a collision, regardless of fault.

- Comprehensive Coverage: This protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This helps cover costs if you're in an accident with a driver who has insufficient or no insurance.

Impact of Coverage Selection

Choosing the right coverage can directly affect your insurance quotes. For example, opting for a higher deductible with comprehensive coverage can lower your premium, as you'll be responsible for more costs out of pocket. On the other hand, selecting minimal coverage may result in lower premiums but leave you vulnerable in case of an accident.

Examples of Cost Reduction

For instance, if you have an older vehicle, it may be more cost-effective to drop collision coverage and opt for liability-only insurance. This can significantly reduce your insurance costs while still meeting legal requirements.

Balance Between Coverage and Affordability

It's essential to strike a balance between comprehensive coverage and affordability. Evaluate your driving habits, the value of your vehicle, and your financial situation to determine the right coverage for your needs. Remember, having adequate coverage is crucial to protect yourself and your assets in case of an accident.

Discounts and Savings

When it comes to lowering your auto insurance costs, taking advantage of discounts and savings opportunities can make a significant difference in your premiums. Insurance companies offer various discounts to help policyholders save money. By understanding these discounts and strategies to qualify for them, you can maximize your savings and get the most affordable coverage possible.

Common Discounts Offered by Insurance Companies

- Good Driver Discount: This discount is typically offered to drivers with a clean driving record, free of accidents or traffic violations.

- Multi-Vehicle Discount: Insuring multiple vehicles under the same policy can often lead to discounted rates.

- Good Student Discount: Students with good grades may be eligible for lower premiums.

- Low Mileage Discount: Driving less than the average miles per year could qualify you for a discount.

Strategies for Qualifying for Discounts

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to qualify for the good driver discount.

- Bundle Policies: Consider bundling your auto insurance with other policies like home or renters insurance to receive a multi-policy discount.

- Ask About Available Discounts: Inquire with your insurance provider about all potential discounts you may qualify for.

Maximizing Savings through Bundling Policies or Loyalty Programs

- Bundling Policies: Combining multiple insurance policies with the same provider can lead to significant savings on premiums.

- Loyalty Programs: Some insurance companies offer loyalty discounts to long-term customers who renew their policies with them.

Comparing the Savings Potential of Different Discount Options

- When considering discount options, compare the potential savings each discount offers to determine which ones will have the most significant impact on your premiums.

- Work with your insurance agent to evaluate the savings of different discount combinations and choose the ones that best fit your needs and budget.

Driving Habits and Driver Monitoring

Safe driving habits play a crucial role in determining your auto insurance premiums. Insurance companies reward safe drivers with lower rates, as they are considered less risky to insure. This makes it essential to maintain good driving habits to potentially lower your insurance costs.

Impact of Driver Monitoring Programs

Driver monitoring programs, such as telematics devices or smartphone apps, track your driving behavior, including speed, braking patterns, and mileage. Insurance companies use this data to assess your risk level accurately. By participating in these programs and demonstrating safe driving habits, you may qualify for discounts on your insurance premiums.

- Telematics Devices: These devices are installed in your vehicle to monitor your driving habits. They collect data on your speed, acceleration, braking, and the time of day you drive. By analyzing this information, insurance companies can offer personalized rates based on your actual driving behavior.

- Smartphone Apps: Some insurance companies offer mobile apps that use GPS technology to track your driving. These apps can provide feedback on your driving habits and offer discounts for safe practices.

Tips for Maintaining a Safe Driving Record

To lower your insurance costs through safe driving habits, consider the following tips:

- Obey Traffic Laws: Follow speed limits, traffic signals, and road signs to avoid accidents and traffic violations.

- Avoid Distractions: Keep your focus on the road by minimizing distractions such as texting, eating, or adjusting the radio while driving.

- Maintain a Safe Following Distance: Keep a safe distance from the vehicle in front of you to allow for ample reaction time in case of sudden stops.

- Regular Vehicle Maintenance: Ensure your vehicle is in good condition by performing regular maintenance checks to prevent breakdowns or accidents due to mechanical failures.

Shopping Around for Quotes

When it comes to lowering your auto insurance rates, one of the most effective strategies is to shop around for quotes. By comparing quotes from different insurance companies, you can find the best rates that suit your budget and coverage needs.

Step-by-Step Guide to Shopping Around

- Start by gathering information about your current coverage and any discounts you may be eligible for.

- Research and make a list of reputable insurance companies in your area.

- Request quotes from at least three different insurance providers to compare rates and coverage options.

- Review the quotes carefully, paying attention to the premiums, deductibles, and coverage limits.

- Select the quote that offers the best value for your money and meets your coverage requirements.

Benefits of Online Comparison Tools

- Online comparison tools allow you to easily compare quotes from multiple insurance companies in a matter of minutes.

- You can quickly identify the most competitive rates and coverage options available in the market.

- These tools make the shopping process convenient and efficient, saving you time and effort.

Tips for Negotiating with Insurance Providers

- Highlight any discounts or savings you qualify for to negotiate for lower rates.

- Ask about bundling your auto insurance with other policies, such as home or renters insurance, for additional discounts.

- Inquire about any available discounts for safe driving habits or completing a defensive driving course.

- Be prepared to negotiate with insurance providers by comparing quotes and leveraging competing offers.

Vehicle Maintenance and Safety Features

Regular vehicle maintenance plays a crucial role in not only keeping your car running smoothly but also impacting your insurance premiums. Additionally, safety features in your vehicle can significantly reduce the risk of accidents, leading to potential savings on insurance costs.

Role of Safety Features

Safety features such as anti-lock brakes, airbags, and electronic stability control are known to reduce the chances of accidents and injuries. Insurance companies often offer discounts for vehicles equipped with these safety features, as they lower the risk of claims and costly payouts.

- Anti-lock Brakes: Vehicles equipped with anti-lock brakes help prevent skidding and maintain control during emergency braking situations, reducing the risk of accidents.

- Airbags: Front, side, and curtain airbags are designed to protect occupants in the event of a collision, reducing the severity of injuries and potential medical costs.

- Electronic Stability Control (ESC): ESC helps drivers maintain control of their vehicles during skidding or loss of traction, especially in slippery road conditions, reducing the likelihood of accidents.

Tips for Upgrading Your Vehicle

If your vehicle does not already have these safety features, consider upgrading to a car that includes them. You can also retrofit certain safety features to your current vehicle, such as installing an aftermarket anti-lock brake system or adding additional airbags.

Not only will these upgrades enhance your safety on the road, but they may also lead to discounts on your auto insurance premiums.

Credit Score and Insurance Rates

Having a good credit score can significantly impact the rates you are offered for auto insurance. Insurance companies often use credit scores as a factor in determining premiums, as they believe there is a correlation between credit history and the likelihood of filing claims.

How Credit Scores Affect Auto Insurance Rates

- Insurance companies believe that individuals with higher credit scores are more responsible and less likely to file claims, leading to lower premiums.

- Conversely, those with lower credit scores may be seen as higher risk and may be charged higher premiums as a result.

Tips for Improving Your Credit Score for Lower Insurance Quotes

- Pay your bills on time to avoid negative marks on your credit report.

- Keep your credit card balances low and try to pay off debts as quickly as possible.

- Regularly check your credit report for errors and dispute any inaccuracies that could be impacting your score.

Strategies for Negotiating Insurance Rates Based on Creditworthiness

- Be transparent about your credit history and ask the insurance company if they offer any discounts for good credit.

- Consider shopping around and comparing quotes from different insurers to find the best rate based on your credit score.

- If your credit score has improved since you last applied for insurance, ask your current provider for a reevaluation to potentially lower your rates.

Usage-Based Insurance Programs

Usage-based insurance programs, also known as telematics programs, involve using technology to monitor your driving habits and adjust your insurance rates accordingly.

How Usage-Based Insurance Works

Insurance companies provide you with a device that tracks various aspects of your driving, such as speed, mileage, braking patterns, and time of day you drive. This data is then used to calculate your insurance premium.

Benefits of Opting for Usage-Based Insurance

- Opportunity for safe drivers to save money on their insurance premiums.

- Encourages safer driving habits, leading to reduced accidents and claims.

- Potential for lower premiums for low-mileage drivers.

Impact of Driving Behavior on Insurance Costs

Examples of how driving behavior can directly impact insurance costs include:

-

Aggressive driving, such as hard braking and accelerating, can lead to higher premiums.

-

Driving at high-risk times, like late at night, can also result in increased insurance costs.

Tips for Enrolling in and Maximizing Savings through Usage-Based Insurance

- Understand how your driving habits are being monitored and evaluated.

- Focus on safe driving practices to qualify for discounts and rewards.

- Regularly review your driving data and make adjustments to improve your habits.

Reviewing and Adjusting Coverage Annually

It is crucial to review and adjust your insurance coverage annually to ensure you have the right protection at the best possible rate. Life changes, market trends, and personal needs can all impact your insurance requirements, making it essential to reassess your coverage regularly.

Factors to Consider When Reassessing Coverage Needs

- Current state insurance requirements

- Changes in your vehicle's value

- Adjustments based on your financial situation

- New drivers or changes in driving habits

Tips for Identifying Opportunities to Lower Insurance Costs

- Ask about available discounts or new offers

- Consider bundling policies for potential savings

- Review your deductibles and coverage limits

- Explore usage-based insurance programs

Impact of Life Changes on Insurance Needs

Life changes such as buying a new car, moving to a new location, or getting married can all impact your insurance needs. These changes may provide opportunities to lower your insurance costs or require adjustments to ensure you have adequate coverage.

Seeking Professional Advice

Seeking professional advice from an insurance agent or broker can be extremely beneficial when trying to lower your auto insurance quote. These professionals have a deep understanding of the insurance industry and can help you navigate the complexities of finding the best coverage at the most affordable rates.

Benefits of Consulting with an Insurance Professional

- Insurance professionals have access to multiple insurance carriers and can compare quotes from different companies to find the best one that suits your needs.

- They can provide personalized advice based on your individual circumstances, helping you choose the right coverage options and discounts that you qualify for.

- Insurance agents or brokers can explain complex insurance terms and conditions in simple terms, ensuring you understand what you are paying for.

Tips for Effectively Communicating with Insurance Professionals

- Come prepared with information about your driving history, the type of coverage you need, and any discounts you may be eligible for.

- Ask questions to clarify any doubts you may have about the coverage options or terms of the policy.

- Be honest and transparent about your driving habits and any previous claims you have made to receive accurate quotes.

Examples of How Seeking Professional Advice Can Help Save on Auto Insurance

- An insurance agent helped a driver bundle their home and auto insurance policies, resulting in a significant discount on both premiums.

- A broker recommended a usage-based insurance program to a low-mileage driver, leading to lower premiums based on actual driving habits.

- By consulting with an insurance professional, a young driver was able to find a policy with a good student discount, reducing their overall insurance costs.

Closing Notes

In conclusion, navigating the world of auto insurance quotes can be a complex yet rewarding experience. By implementing these top 10 tips, you'll be well-equipped to lower your insurance costs efficiently and effectively. Here's to safer roads and more affordable coverage for all drivers.

Popular Questions

What factors impact auto insurance rates the most?

Factors like age, driving record, vehicle type, and location have a significant influence on auto insurance rates. Improving these factors can lead to lower insurance quotes.

How can I maximize savings through discounts?

To maximize savings, qualify for common discounts, bundle policies, and explore loyalty programs. Comparing different discount options can also help save on insurance costs.

Why is reviewing and adjusting coverage annually important?

Reviewing coverage annually ensures that your insurance needs are up to date. It helps in identifying opportunities to lower costs and adapting to life changes that impact insurance quotes.