Auto Insurance Quote Comparison: Which Company Is the Best? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Comparing auto insurance quotes is crucial for making an informed decision on the best coverage. With numerous factors to consider, finding the right insurance company can be a daunting task. Let's explore the ins and outs of this process to help you navigate the world of auto insurance with confidence.

Overview of Auto Insurance Quote Comparison

When it comes to getting auto insurance, comparing quotes from different companies is crucial to ensure you are getting the best coverage at the most competitive price. By comparing auto insurance quotes, you can save money and find a policy that meets your specific needs.

Importance of Comparing Auto Insurance Quotes

Comparing auto insurance quotes allows you to evaluate different coverage options and prices offered by various insurance companies. This helps you make an informed decision and choose a policy that provides the right protection at a reasonable cost.

Factors to Consider when Comparing Insurance Quotes

- Coverage Options: Look at the types of coverage included in each quote and ensure they meet your needs, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Deductibles and Limits: Compare the deductibles and coverage limits of each quote to understand how much you would have to pay out of pocket in the event of a claim.

- Discounts: Check for any discounts offered by insurance companies, such as multi-policy, safe driver, or good student discounts, which can help lower your premium.

- Customer Service: Research the reputation of each insurance company for customer service and claims handling to ensure you will receive support when needed.

Benefits of Comparing Auto Insurance Quotes

- Cost Savings: By comparing quotes, you can find a policy that offers the coverage you need at a price that fits your budget, potentially saving you money in the long run.

- Customization: Comparing quotes allows you to tailor your policy to your specific requirements, ensuring you are not overpaying for coverage you do not need.

- Quality Coverage: Through comparison, you can identify insurance companies with a good reputation for providing reliable coverage and excellent customer service.

Methodology for Auto Insurance Quote Comparison

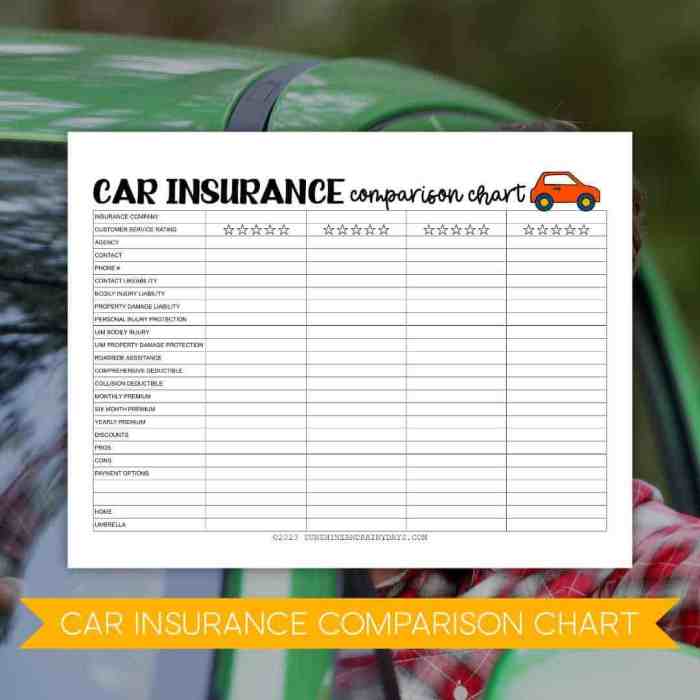

When comparing auto insurance quotes from different companies, it's important to follow a systematic process to ensure accuracy and thorough evaluation. Here is a step-by-step guide on how to effectively compare quotes and make an informed decision.

Step-by-Step Process for Obtaining and Comparing Quotes

- Start by gathering information about your current coverage, including limits and deductibles.

- Research and identify reputable auto insurance companies that offer quotes online or over the phone.

- Provide accurate and consistent information when requesting quotes to get an apples-to-apples comparison.

- Review the quotes received, paying attention to premiums, coverage limits, deductibles, and any discounts offered.

- Consider additional factors like customer service reputation, financial strength of the company, and ease of claims process.

- Select the quote that best meets your needs and budget, keeping in mind the overall value and coverage provided.

Tips on Accurately Comparing Quotes from Different Companies

- Ensure the coverage limits and deductibles are the same for each quote to make a fair comparison.

- Look for any exclusions or limitations in the policy that could impact your coverage in the future.

- Consider the reputation of the insurance company and read reviews from other policyholders to gauge customer satisfaction.

- Take advantage of discounts offered by insurers, but make sure they are reflected in the final quote.

- Ask questions about any terms or conditions that are unclear to ensure you fully understand the policy.

Importance of Reviewing Coverage Options and Policy Details

- Comparing auto insurance quotes goes beyond just looking at the premium cost; it's crucial to review the coverage options and policy details.

- Understanding what is covered (and what is not) can help you avoid surprises and ensure you have adequate protection in case of an accident.

- By carefully reviewing the policy details, you can make an informed decision that meets your needs and provides peace of mind on the road.

Factors to Consider When Comparing Auto Insurance Quotes

When comparing auto insurance quotes, there are several key factors that can influence the premiums you are quoted. Understanding these factors can help you make an informed decision when selecting an insurance policy that meets your needs and budget.

Main Factors Affecting Auto Insurance Premiums

- Driving Record: Your past driving history, including any accidents or traffic violations, can impact your insurance rates. Safe drivers typically receive lower premiums.

- Location: Where you live can also affect your insurance rates. Urban areas with higher rates of accidents or theft may result in higher premiums.

- Vehicle Type: The make and model of your car, as well as its age and safety features, can influence your insurance costs.

- Coverage Limits: The amount of coverage you choose for liability, collision, and comprehensive insurance will impact your premiums.

- Deductibles: The deductible is the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your premiums, but you'll pay more in the event of a claim.

How Coverage Limits, Deductibles, and Types of Coverage Impact Insurance Quotes

- Higher coverage limits typically result in higher premiums, as you are paying for more protection in case of an accident.

- Choosing a lower deductible means you'll pay less out of pocket in the event of a claim, but your premiums will likely be higher.

- The type of coverage you select, such as liability, collision, and comprehensive, will also affect your insurance quotes. Comprehensive coverage, for example, covers damage to your vehicle from non-collision incidents like theft or natural disasters.

Role of Personal Driving History and Location in Determining Insurance Rates

- Your personal driving history, including any accidents or traffic violations, is a key factor in determining your insurance rates. Safe drivers with a clean record typically receive lower premiums.

- Where you live can also impact your insurance rates. Urban areas with higher rates of accidents or theft may result in higher premiums compared to rural areas.

Comparison of Top Auto Insurance Companies

When comparing the top auto insurance companies in the market, it's essential to look at various factors such as coverage options, customer service, pricing, and overall satisfaction levels. Analyzing customer reviews and ratings can provide valuable insights into the strengths and weaknesses of each insurance provider.

State Farm

State Farm is known for its extensive network of agents and personalized customer service. They offer a wide range of coverage options, including auto, home, and life insurance. State Farm also provides discounts for policyholders who bundle multiple policies together.

Geico

Geico is popular for its competitive pricing and user-friendly online tools. They have a simple quote process and offer various discounts based on factors such as driving history, vehicle safety features, and more. Geico is often praised for its responsive claims handling and customer support.

Progressive

Progressive is recognized for its innovative tools like Snapshot, which tracks driving habits to potentially lower premiums. They offer a variety of coverage options, including roadside assistance and rental car reimbursement. Progressive also stands out for its easy-to-use website and mobile app.

Allstate

Allstate is known for its customizable coverage options and strong financial stability. They provide features like accident forgiveness and new car replacement coverage. Allstate offers discounts for safe driving, anti-theft devices, and more, making it a popular choice for many drivers.

USAA

USAA caters to military members and their families, offering specialized coverage options and personalized service. They consistently receive high ratings for customer satisfaction and claims handling. USAA provides competitive rates and discounts for military service members, making it a top choice for those eligible.

Utilizing Online Tools for Auto Insurance Quote Comparison

When it comes to comparing auto insurance quotes, utilizing online tools can make the process much easier and more efficient. Online platforms offer a convenient way to quickly gather and compare quotes from different insurance companies, helping you find the best coverage at the best price.

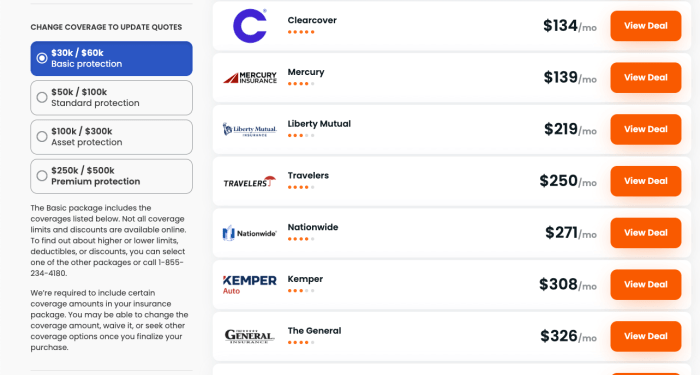

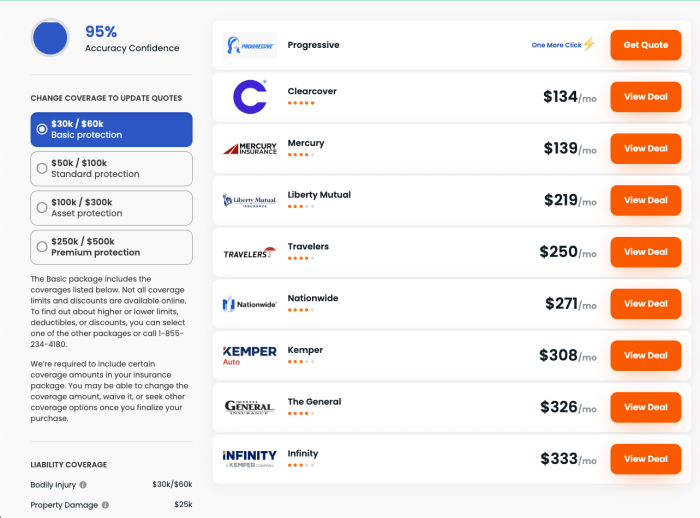

Popular Online Platforms for Auto Insurance Quote Comparison

There are several popular online platforms that allow you to compare auto insurance quotes from multiple companies. Some of the most commonly used tools include:

- Insurance comparison websites like Compare.com, The Zebra, and Gabi

- Insurance company websites that offer quote comparison tools

- Mobile apps that specialize in providing insurance quote comparisons

How to Use Online Comparison Tools Effectively

Using online comparison tools effectively involves entering accurate information about your vehicle, driving history, and coverage preferences. Make sure to review the details of each quote carefully, including coverage limits, deductibles, and any additional features or discounts.

Reliability and Accuracy of Online Quote Comparison Platforms

While online quote comparison platforms can provide a good starting point for finding affordable auto insurance, it's essential to remember that the quotes generated are estimates based on the information you provide. Factors such as your driving record, location, and credit score can all impact the final premium you receive from an insurance company.

Ultimate Conclusion

In conclusion, the quest for the best auto insurance company involves careful consideration of various aspects like coverage options, pricing, and customer satisfaction. By conducting a thorough comparison, you can secure the ideal policy that meets your needs. Remember, informed choices lead to peace of mind on the road ahead.

FAQ Explained

What factors should I consider when comparing auto insurance quotes?

When comparing quotes, factors like coverage limits, deductibles, types of coverage, personal driving history, and location play a significant role in determining insurance rates.

How do I accurately compare quotes from different companies?

To accurately compare quotes, ensure you're evaluating similar coverage options and policy details. Pay attention to any unique features or discounts offered by each company to make an informed decision.

Why is it important to review coverage options during the comparison process?

Reviewing coverage options helps you understand the extent of protection each policy offers. This step is crucial in ensuring you select a plan that aligns with your needs and provides adequate coverage in case of unforeseen events.