Delving into the realm of auto insurance quotes, one crucial factor that often goes unnoticed is the influence of credit scores. Understanding how your credit score can significantly impact the rates you receive is essential for making informed decisions about your insurance coverage.

Let's explore the intricate relationship between credit scores and auto insurance quotes.

As we navigate through the complexities of insurance premiums and credit scores, a clearer picture emerges of how financial health can directly affect the cost of your auto insurance.

Importance of Credit Score in Auto Insurance

Having a good credit score can significantly impact the auto insurance quotes you receive. Insurance companies use your credit score to assess your level of risk as a policyholder.

Impact on Insurance Premiums

Insurance companies often consider individuals with higher credit scores to be more responsible and less likely to file claims. As a result, they are likely to offer lower insurance premiums to those with good credit scores. Conversely, individuals with lower credit scores may be viewed as higher risk and therefore may face higher insurance premiums.

Determining Rates

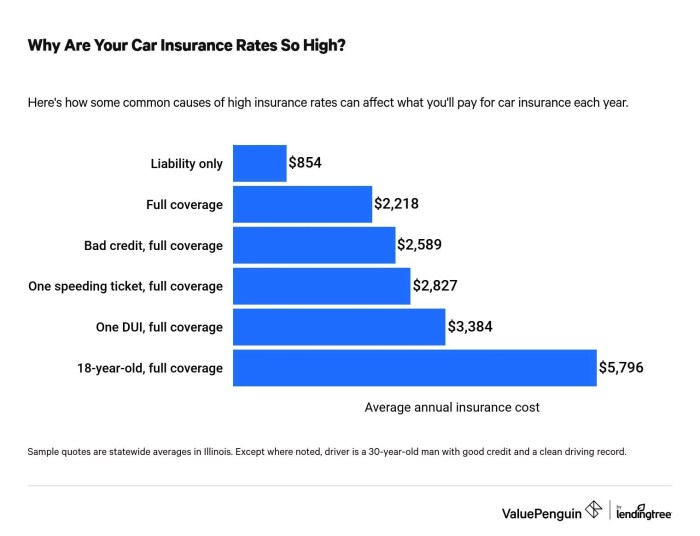

Insurance companies use credit scores along with other factors, such as driving record and age, to determine the rates for auto insurance policies. A lower credit score can lead to increased rates, while a higher credit score can help lower your premiums.

Factors Influencing Insurance Costs

When it comes to determining insurance premiums, several factors come into play beyond just credit score. These additional factors can significantly impact the cost of your auto insurance.

Driving Record

Having a history of accidents or traffic violations can lead to higher insurance rates. Insurance companies view drivers with a clean record as less risky and therefore offer lower premiums.

Age and Gender

Younger drivers, especially teenagers, are often charged higher insurance rates due to their lack of experience behind the wheel. Additionally, statistics show that male drivers tend to be involved in more accidents than female drivers, leading to higher premiums for men.

Vehicle Type

The make and model of your vehicle can also influence your insurance costs. Cars with high safety ratings and lower theft rates typically result in lower premiums. On the other hand, sports cars and luxury vehicles may come with higher insurance costs.

Location

Where you live can impact your insurance rates as well. Urban areas with higher traffic congestion and crime rates tend to have higher premiums compared to rural areas with lower risk factors.

Credit Score vs. Other Factors

While credit score is an important factor in determining insurance rates, it is not the only one. Your driving record, age, gender, vehicle type, and location all play a role in how much you will pay for auto insurance. However, studies have shown that credit score can have a significant impact on insurance premiums, sometimes even outweighing other factors.

Credit Score Ranges and Insurance Rates

Maintaining a good credit score is crucial when it comes to determining your auto insurance rates. Insurance companies often use credit scores as a factor in calculating premiums, as they believe it reflects the likelihood of a policyholder filing a claim.

Effect of Different Credit Score Ranges on Insurance Premiums

- Excellent Credit (800-850): Individuals with excellent credit scores tend to receive the lowest insurance rates. They are seen as responsible and less likely to file claims.

- Good Credit (670-799): Those with good credit scores also benefit from lower insurance premiums compared to average or poor credit scores.

- Fair Credit (580-669): People with fair credit scores may experience slightly higher insurance rates due to the perceived increased risk of filing claims.

- Poor Credit (300-579): Individuals with poor credit scores often face the highest insurance premiums, as they are viewed as higher risks for insurance companies.

Impact of Low Credit Score on Insurance Costs

Having a low credit score can significantly increase your insurance costs. For example, a driver with a poor credit score may end up paying double or even triple the premium of someone with an excellent credit score for the same coverage.

Insurance premiums can increase by up to 100% or more for individuals with poor credit compared to those with excellent credit.

Strategies for Improving Credit Score to Lower Insurance Rates

- Pay bills on time: Timely payments can help boost your credit score over time.

- Reduce debt: Lowering your overall debt can positively impact your credit score.

- Monitor credit report: Regularly check your credit report for errors and address them promptly.

- Keep credit utilization low: Aim to use only a small portion of your available credit to improve your score.

Legalities and Regulations

In the United States, the use of credit scores in insurance pricing is a common practice among auto insurance companies. However, there are certain legalities and regulations in place to govern the use of credit information in insurance.

State Regulations

Each state has its own set of regulations regarding the use of credit scores in insurance. Some states have banned or limited the use of credit information in insurance pricing, while others allow it with certain restrictions. It is important to be aware of the specific regulations in your state to understand how your credit score affects your auto insurance rates.

Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) regulates the collection, dissemination, and use of consumer credit information. Under the FCRA, insurance companies must inform consumers if their credit information was a factor in determining their insurance rates. Consumers also have the right to dispute any inaccuracies in their credit reports that may be affecting their insurance premiums.

Recent Changes

In recent years, there have been discussions and proposed legislation to further regulate the use of credit scores in insurance. Some states have introduced bills to restrict or prohibit the use of credit information in insurance pricing. It is important to stay informed about any changes in laws or regulations that may impact how credit scores are used in determining auto insurance quotes.

Closure

In conclusion, the correlation between credit scores and auto insurance quotes is undeniable. By comprehending this connection and taking proactive steps to improve your credit score, you can potentially lower your insurance rates and secure more affordable coverage. Make informed choices about your financial well-being and drive confidently knowing you have a better understanding of how credit scores impact your auto insurance quotes.

Commonly Asked Questions

How does my credit score affect my auto insurance quote?

Your credit score can influence the rate you receive for auto insurance. A higher credit score is often associated with lower insurance premiums.

What are some strategies to improve my credit score and lower my insurance rates?

To enhance your credit score for better insurance rates, you can focus on paying bills on time, reducing debt, and monitoring your credit report regularly.

Are there other factors besides credit score that impact insurance costs?

Yes, factors such as driving record, age, type of vehicle, and location can also affect insurance premiums.

Are there specific credit score ranges that have a significant impact on insurance rates?

Lower credit scores can lead to higher insurance costs, while higher credit scores are often associated with lower premiums.

What laws govern the use of credit scores in insurance pricing?

There are regulations that dictate how insurance companies can use credit information in determining rates to ensure fairness and prevent discrimination.