7 Things to Know Before You Shop Auto Insurance Policies sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

The content of the second paragraph that provides descriptive and clear information about the topic

Understanding Auto Insurance Policies

When it comes to auto insurance policies, it is important to understand the basic components and coverage options available to make an informed decision. Let's break down the key points to consider before shopping for auto insurance.

Basic Components of an Auto Insurance Policy

- Liability Coverage: This covers damages and injuries you are legally responsible for in an accident.

- Collision Coverage: This pays for damages to your own vehicle in the event of a collision.

- Comprehensive Coverage: This provides coverage for damages not caused by a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are in an accident with a driver who has insufficient insurance coverage.

Comparison of Different Types of Coverage Options

- Full Coverage: This includes liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Minimum Coverage: This meets the legal requirements but may not offer sufficient protection in all situations.

- Additional Coverage Options: You can add extras like roadside assistance, rental car reimbursement, or gap insurance for more comprehensive protection.

Examples of How Coverage Limits Work

- For liability coverage, you may see limits like 100/300/50, which means $100,000 per person for bodily injury, $300,000 per accident for bodily injury, and $50,000 per accident for property damage.

- Understanding these limits is crucial to ensure you have adequate coverage in case of an accident.

Factors Influencing Auto Insurance Rates

When it comes to determining auto insurance rates, several factors come into play that can impact how much you pay for coverage. Understanding these factors can help you make informed decisions when shopping for auto insurance.

Driving Record

Your driving record is one of the key factors that insurance companies consider when determining your insurance premiums. If you have a history of accidents, traffic violations, or other driving infractions, you may be considered a higher risk driver, leading to higher insurance rates.

Type of Vehicle

The type of vehicle you drive can also impact your insurance costs. Generally, newer and more expensive cars will cost more to insure due to the higher cost of repairs or replacement. Additionally, certain models may be more prone to theft or have higher safety risks, which can also affect insurance rates.

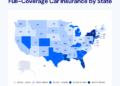

Location

Where you live plays a significant role in determining your auto insurance rates. Urban areas with higher traffic congestion and crime rates may have higher insurance premiums compared to rural areas. Additionally, factors like weather conditions, road infrastructure, and the frequency of accidents in your area can all influence your insurance costs.

Shopping Around for Auto Insurance

When it comes to buying auto insurance, it's essential to shop around and compare quotes from different insurance providers. This can help you find the best coverage at the most competitive price.

Importance of Getting Multiple Quotes

- Getting multiple quotes allows you to compare prices and coverage options offered by different insurance companies.

- By exploring various options, you can find the policy that best suits your needs and budget.

- Insurance rates can vary significantly between providers, so shopping around can help you save money.

Benefits of Using Online Comparison Tools

- Online comparison tools make it easy to get multiple quotes from different insurance companies in a matter of minutes.

- These tools allow you to compare prices, coverage options, and customer reviews all in one place.

- Using online tools can save you time and effort compared to contacting each insurer individually.

Explaining How Bundling Policies Can Lead to Cost Savings

- Many insurance companies offer discounts to customers who bundle multiple policies, such as auto and home insurance.

- By bundling your policies with one insurer, you can often save money on your overall insurance costs.

- Consolidating your policies can also make it easier to manage your coverage and payments.

Understanding Deductibles and Premiums

When it comes to auto insurance, understanding deductibles and premiums is crucial in determining the cost of your coverage. Deductibles are the amount of money you agree to pay out of pocket before your insurance kicks in to cover the rest of the cost in the event of a claim.

Premiums, on the other hand, are the amount you pay to the insurance company for your coverage.

High Deductible vs. Low Deductible Scenarios

- High Deductible: Choosing a higher deductible can lower your monthly premium, but it also means you'll have to pay more out of pocket before your insurance starts covering costs. For example, opting for a $1,000 deductible may result in lower monthly payments, but you'll need to have that $1,000 available in case of an accident.

- Low Deductible: On the other hand, selecting a lower deductible means higher monthly premiums but less money to pay upfront in the event of a claim. For instance, a $250 deductible might mean higher monthly payments, but you'll only need to come up with $250 if you need to file a claim.

Strategies for Choosing the Right Deductible Amount

- Assess Your Financial Situation: Consider how much you can comfortably afford to pay out of pocket in the event of an accident. If you have savings set aside for emergencies, you may be able to opt for a higher deductible.

- Balance Premiums and Deductibles: Find a deductible amount that strikes a balance between lower monthly premiums and a manageable out-of-pocket cost. Evaluate how much you can save on premiums versus how much you'd have to pay if you need to file a claim.

- Consider Your Driving Habits: If you have a clean driving record and feel confident in your abilities on the road, you might be comfortable with a higher deductible. However, if you're concerned about the possibility of accidents, a lower deductible could provide peace of mind.

Coverage Limits and Additional Options

When it comes to auto insurance policies, understanding coverage limits and additional options is crucial for making informed decisions about your coverage. This includes knowing the extent of protection your policy offers and the additional features you can add for extra protection and peace of mind.

Coverage Limits

- Insurance coverage limits refer to the maximum amount your insurance company will pay out for a covered claim. It's important to choose coverage limits that adequately protect you in case of an accident or other covered event.

- Common coverage limits include liability coverage, which pays for damages and injuries you cause to others, and comprehensive and collision coverage, which pay for damage to your vehicle.

Additional Options

- Roadside Assistance: This coverage provides help if your car breaks down or you need towing. It can be a valuable add-on for peace of mind on the road.

- Rental Car Reimbursement: If your car is in the shop after an accident, this coverage helps pay for a rental car so you can still get around.

- Gap Insurance: If your car is totaled in an accident, gap insurance covers the difference between what you owe on your car loan and the car's actual cash value.

It's essential to carefully review the fine print of your policy to understand any exclusions or limitations to your coverage. Make sure you know exactly what is and isn't covered before you need to file a claim.

Factors to Consider Before Choosing a Policy

When selecting an auto insurance policy, there are several crucial factors to keep in mind that can significantly impact your overall experience. It's essential to evaluate the financial stability and reputation of insurance companies, prioritize customer service and claims handling, and seek feedback from other policyholders.

Financial Stability and Reputation of Insurance Companies

Before committing to an auto insurance policy, it's crucial to research the financial stability and reputation of the insurance companies you are considering. A financially stable insurer is more likely to fulfill its obligations and pay out claims promptly. You can check the financial ratings of insurance companies from independent rating agencies like A.M.

Best, Moody's, or Standard & Poor's.

Importance of Customer Service and Claims Handling

Customer service and claims handling are critical aspects of an auto insurance policy that can significantly impact your experience in the event of an accident or claim. It's essential to choose an insurer known for providing excellent customer service and handling claims efficiently.

You can gauge the quality of customer service by reading reviews and seeking recommendations from friends or family members.

Reading Reviews and Seeking Recommendations

One way to assess the reliability and reputation of an insurance company is by reading reviews from current and past policyholders. Online platforms like Consumer Reports, J.D. Power, and the National Association of Insurance Commissioners (NAIC) provide valuable insights into the customer experience with different insurers.

Additionally, seeking recommendations from friends, family, or trusted advisors can help you make an informed decision when choosing an auto insurance policy.

Policy Renewals and Adjustments

When it comes to auto insurance policies, renewals and adjustments are important aspects that policyholders need to be aware of. Understanding how policy renewals work, factors that can lead to adjustments in premiums, and the importance of reviewing and updating coverage periodically can help you make informed decisions to ensure you have the right coverage in place.

Renewing Auto Insurance Policies

Policy renewals typically occur annually, although the frequency may vary depending on the insurance provider. It is essential to review your policy details and coverage before the renewal date to ensure that you have the appropriate coverage for your needs.

During the renewal process, you may have the opportunity to make adjustments to your policy, such as adding or removing coverage options, updating personal information, or adjusting deductibles.

Factors Leading to Adjustments in Premiums

- Changes in driving habits or mileage: If your driving habits have changed significantly, such as driving less frequently or taking public transportation, you may be eligible for lower premiums.

- Accident history: If you have been involved in accidents or received traffic violations since your last renewal, this can impact your premiums.

- Changes in personal information: Updates to your address, marital status, or adding new drivers to your policy can affect your premiums.

- Credit score changes: Some insurance companies consider credit scores when calculating premiums, so changes to your credit score can result in adjustments to your premiums.

Reviewing and Updating Coverage Periodically

It is essential to review your auto insurance coverage periodically to ensure that it still meets your needs. Life changes, such as purchasing a new vehicle, moving to a new location, or changes in your financial situation, may require adjustments to your coverage.

By staying proactive and reviewing your policy regularly, you can make sure you have the right coverage in place and avoid any gaps in protection.

Last Recap

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

FAQs

What factors can influence auto insurance rates?

Driving record, type of vehicle, and location are key factors that can impact insurance rates.

How can I save on auto insurance costs?

You can save on auto insurance costs by getting multiple quotes, using online comparison tools, and bundling policies.

What should I consider before choosing an insurance policy?

Consider the financial stability of insurance companies, their reputation, customer service, and claims handling when choosing a policy.

How do policy renewals and adjustments work?

Policy renewals involve renewing the policy, while adjustments in premiums can be influenced by various factors. It's important to review and update coverage periodically.