Kicking off with Auto Insurance Quote vs Estimate: What’s the Difference?, this opening paragraph is designed to captivate and engage the readers, providing an interesting overview of the distinction between auto insurance quotes and estimates.

Delving into the realm of auto insurance, understanding the nuances between quotes and estimates is crucial for making informed decisions regarding insurance coverage.

Understanding Auto Insurance Quote and Estimate

When it comes to auto insurance, understanding the difference between a quote and an estimate is crucial. Here's a breakdown of what each entails:

Auto Insurance Quote

An auto insurance quote is a personalized offer from an insurance company outlining the cost of coverage based on the information provided by the individual seeking insurance. It is a detailed proposal that includes the specific coverage options, deductibles, and premiums that would apply to the policy.

Auto Insurance Estimate

On the other hand, an auto insurance estimate is a rough calculation of the potential cost of insurance based on general information such as the type of vehicle, location, driving record, and other basic details. It is not as detailed or specific as a quote and is meant to provide a general idea of what the insurance premium might be.

Difference between a Quote and an Estimate

- An auto insurance quote is a specific offer tailored to an individual, including detailed coverage options and premiums, while an estimate is a general calculation based on basic information.

- A quote is more accurate and binding, whereas an estimate is more of a ballpark figure that can change once more detailed information is provided.

- When making decisions about insurance coverage, it is important to obtain a formal quote to ensure accuracy and avoid any surprises.

Factors Influencing Auto Insurance Quotes and Estimates

When it comes to auto insurance, there are several key factors that can influence the quotes and estimates provided by insurance companies. These factors play a significant role in determining the cost of your insurance coverage and can vary based on individual circumstances.

Key Factors Affecting Auto Insurance Quotes

- Your Driving Record: One of the most important factors that affect your auto insurance quote is your driving record. If you have a history of accidents or traffic violations, you are considered a higher risk driver and may receive a higher quote.

- Your Age: Younger drivers, especially those under 25, tend to pay higher insurance premiums due to their lack of driving experience. Older drivers may also face higher rates as they are considered more prone to accidents.

- Type of Vehicle: The make, model, and age of your vehicle can also impact your insurance quote. Expensive cars or those with high theft rates may result in higher premiums.

Impact of Factors on Insurance Pricing

- Driving Record: A clean driving record can lower your insurance premium, while a history of accidents or violations can increase it significantly.

- Age: Younger and older drivers typically pay more for insurance due to the statistical likelihood of accidents in these age groups.

- Vehicle Type: Luxury cars, sports cars, and vehicles with expensive repair costs will generally have higher insurance premiums compared to more affordable and reliable models.

Variables Influencing Insurance Estimates

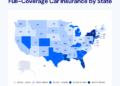

- Location: Where you live can impact your insurance estimate, with urban areas generally having higher rates due to increased traffic and crime rates.

- Mileage: The amount you drive annually can also affect your insurance estimate, as more time on the road increases the risk of accidents.

- Coverage Options: The type and amount of coverage you choose will directly impact your insurance estimate, with more comprehensive coverage options leading to higher premiums.

Process of Obtaining an Auto Insurance Quote vs Estimate

When it comes to auto insurance, understanding the process of obtaining a quote versus an estimate is essential. Let's delve into the steps involved in getting an auto insurance quote, how insurance companies calculate estimates for policies, and the key differences in the information required for each.

Obtaining an Auto Insurance Quote

- Request a Quote: The first step is to reach out to insurance companies or use online platforms to request a quote for your vehicle.

- Provide Information: You will need to provide details about your driving history, the vehicle you want to insure, and your personal information.

- Quote Calculation: Insurance companies use algorithms and risk assessment models to calculate the premium based on the information provided.

- Receive Quote: Once the calculation is done, you will receive a quote outlining the coverage options and premium amount.

Calculating an Insurance Estimate

- Assessing Risk Factors: Insurance companies evaluate various risk factors such as the driver's age, location, driving record, and the type of vehicle to estimate the potential cost of coverage.

- Estimation Process: Estimates are calculated based on statistical data, actuarial analysis, and historical claims to determine the likely cost of providing insurance coverage.

- Range of Costs: Unlike a fixed quote, estimates provide a range of possible costs based on the identified risk factors and other variables.

Information Required for Quote vs Estimate

- Quote: Insurance quotes require specific details about the vehicle, driver, and coverage preferences to generate a precise premium amount.

- Estimate: Estimates rely on broader information about risk factors and general data to provide a projected cost range for insurance coverage.

- Detailed vs. General: Quotes demand detailed and accurate data for a specific premium, while estimates offer a more generalized overview of potential costs.

Accuracy and Reliability of Auto Insurance Quotes and Estimates

When it comes to auto insurance, getting an accurate quote or estimate is crucial for policyholders to make informed decisions. Let's delve into the accuracy and reliability of auto insurance quotes and estimates to understand their impact on policyholders.

Accuracy of Auto Insurance Quotes

- Auto insurance quotes are based on information provided by the policyholder, such as driving record, age, location, and type of vehicle. The accuracy of these quotes depends on the accuracy of the information provided.

- Insurance companies use complex algorithms and actuarial data to calculate quotes, but they are still estimates and may not always reflect the actual cost of the policy.

- Factors like changes in driving habits, additional drivers, or moving to a different location can impact the accuracy of the initial quote.

Reliability of Insurance Estimates

- Insurance estimates are meant to predict the final premiums that policyholders will pay based on the information provided. While estimates can give a rough idea of the cost, they are not set in stone.

- Estimates can change due to factors like underwriting guidelines, changes in regulations, or new data that becomes available to the insurance company.

- Policyholders should be aware that estimates are subject to change and may not always accurately predict the final premium they will pay.

Impact of Discrepancies between Quotes and Estimates

- Discrepancies between quotes and estimates can lead to confusion and frustration for policyholders. If the final premium ends up being significantly different from the initial quote or estimate, it can disrupt budgeting and financial planning.

- Policyholders may feel misled or deceived if the final premium is much higher than what was initially quoted, leading to a breakdown in trust between the policyholder and the insurance company.

- It is essential for policyholders to regularly review their insurance documents and communicate with their insurance company to ensure that they are aware of any changes that may impact their premiums.

Outcome Summary

Wrapping up our discussion on Auto Insurance Quote vs Estimate: What’s the Difference?, it becomes evident that the variance between quotes and estimates can significantly impact policyholders' financial decisions and coverage choices.

Question Bank

What information does an auto insurance quote provide?

An auto insurance quote offers a specific premium cost based on the information provided by the individual seeking insurance.

How does age influence auto insurance estimates?

Age can impact auto insurance estimates as younger drivers are typically considered higher risk and may receive higher premium quotes.

Are auto insurance quotes always accurate?

Auto insurance quotes provide an estimated cost but may not always reflect the final premium due to various factors.