How to Get an Accurate Auto Insurance Quote Online in 2025 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve deeper into understanding the components of auto insurance quotes, exploring technological advancements for accurate quotes, and providing tips on navigating changes in the industry, readers will gain valuable insights into securing the best coverage for their vehicles.

Understanding Auto Insurance Quotes

When obtaining an auto insurance quote, it is crucial to understand the various components that make up the final rate. These components are influenced by a variety of factors that can impact the accuracy of the quote.

Components of an Auto Insurance Quote

- The type of coverage required, such as liability, collision, or comprehensive.

- The deductible amount chosen by the policyholder.

- The limits of coverage for bodily injury and property damage.

- The make, model, and age of the vehicle being insured.

Factors Influencing Auto Insurance Rates

- Driving record, including past accidents and traffic violations.

- Age, gender, and marital status of the driver.

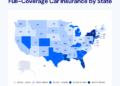

- Location where the vehicle is primarily kept or driven.

- Credit score and insurance history of the policyholder.

Importance of Accuracy in Auto Insurance Quotes

Accurate information provided during the quoting process is essential to ensure that the policyholder receives the correct coverage at the right price. Inaccuracies in the information provided could lead to incorrect quotes, potential claims issues, or even policy cancellations.

Utilizing Technology for Accurate Quotes

In today's digital age, advancements in technology have revolutionized the way we obtain auto insurance quotes. Gone are the days of lengthy phone calls or in-person visits to insurance agencies. Online tools now allow us to easily and efficiently compare quotes from multiple providers to ensure we are getting the best coverage at the most competitive rates.Traditional methods of obtaining auto insurance quotes involved contacting individual insurance companies or brokers, providing personal information, and waiting for them to manually calculate a quote based on various factors such as driving history, vehicle details, and coverage preferences.

This process was often time-consuming and lacked the convenience of instant results.On the other hand, online methods for obtaining auto insurance quotes have streamlined the process significantly. With just a few clicks, users can input their information into a secure online portal and receive accurate quotes from multiple insurance providers within minutes.

These online tools utilize sophisticated algorithms that take into account a wide range of variables to provide accurate and personalized quotes tailored to each individual's unique circumstances.The benefits of using online tools for obtaining auto insurance quotes are abundant. Firstly, the convenience factor cannot be overstated.

Users can access these tools at any time of the day or night, from the comfort of their own homes. This eliminates the need for scheduling appointments or waiting on hold to speak with a representative. Additionally, online tools allow users to compare quotes from multiple providers side by side, enabling them to make an informed decision based on both coverage options and pricing.Furthermore, online tools often provide transparency in the quoting process, breaking down the factors that contribute to the final premium.

This level of detail allows users to understand why certain quotes may be higher or lower than others, empowering them to make adjustments to their coverage preferences if needed.Overall, utilizing technology for obtaining auto insurance quotes offers a more efficient, convenient, and transparent experience for consumers, ensuring they are able to make well-informed decisions when selecting the right coverage for their needs.

Providing Accurate Information

When obtaining an auto insurance quote online, it is crucial to provide accurate information to ensure the quote you receive is as close to the final premium as possible. Inaccurate information can lead to incorrect quotes, resulting in potential issues when finalizing your policy.

Information Required for an Accurate Quote

- Personal Details: Name, age, address, occupation

- Vehicle Information: Year, make, model, VIN

- Driving History: Accidents, tickets, claims

- Coverage Preferences: Liability limits, deductibles, additional coverage

- Mileage: Estimated annual mileage

Impact of Accurate Information on Quotes

Accurate information directly influences the quote you receive. Insurance companies use this data to assess your risk profile and determine the premium you will pay. Providing incorrect details can lead to underestimating or overestimating your risk, resulting in inaccurate quotes.

Verifying Information Accuracy

- Double-check all details before submitting your information.

- Ensure consistency in the information provided across different platforms.

- Verify the VIN number of your vehicle to avoid any mistakes.

- Review your driving history for accuracy and update any outdated information.

Navigating Changes in the Insurance Industry

As technology continues to advance and consumer needs shift, the auto insurance industry is expected to undergo significant changes by 2025. Staying informed about these changes is crucial to obtaining accurate online insurance quotes.

Evolving Trends in the Insurance Industry

With the rise of autonomous vehicles, usage-based insurance, and artificial intelligence, the insurance industry is likely to see a shift towards more personalized and tech-driven policies. These changes could impact how online quotes are generated and the factors considered in determining premiums.

Impact of Emerging Trends on Online Quotes

- Usage-based insurance: Insurers may increasingly rely on telematics data to assess individual driving habits, potentially leading to more customized quotes.

- Artificial intelligence: AI algorithms may be used to analyze vast amounts of data quickly, allowing for more accurate risk assessments and pricing.

- Cybersecurity concerns: As more personal data is shared online, insurers will need to enhance data protection measures to ensure the accuracy and security of online quotes.

Staying Informed About Industry Changes

To navigate these evolving trends and ensure you are getting the most accurate online insurance quotes, it is essential to stay informed about industry developments. This can be done by regularly reading industry publications, attending webinars or seminars, and engaging with insurance professionals who can provide insights into the latest changes.

Outcome Summary

In conclusion, How to Get an Accurate Auto Insurance Quote Online in 2025 equips readers with the knowledge and tools necessary to make informed decisions about their auto insurance needs. By staying informed and utilizing online resources effectively, individuals can ensure they receive accurate quotes and optimal coverage in the evolving landscape of the insurance industry.

Query Resolution

What factors influence auto insurance rates?

Auto insurance rates are influenced by various factors such as age, driving history, type of vehicle, and location. Insurers use these factors to assess risk and determine premiums.

How can I verify the accuracy of the information provided for an auto insurance quote?

You can verify the accuracy of the information by double-checking details such as your driving record, vehicle information, and coverage needs. Providing correct and up-to-date information ensures a more precise quote.

What are some emerging trends that could affect the accuracy of online insurance quotes by 2025?

Emerging trends such as usage-based insurance, AI-driven pricing models, and blockchain technology could impact the accuracy of online insurance quotes by 2025. These advancements may lead to more personalized and precise quotes.