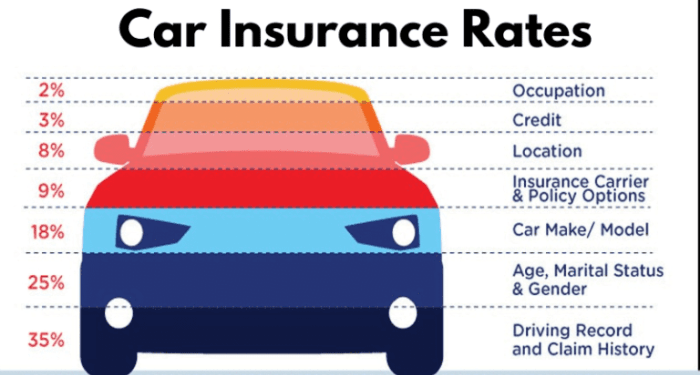

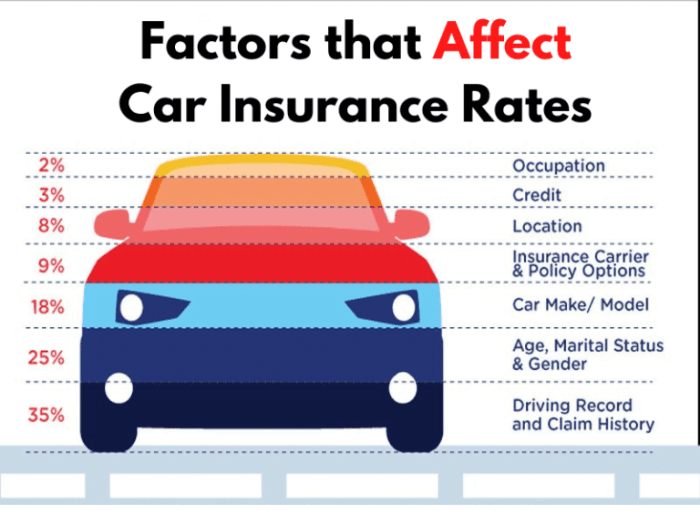

Exploring the key elements that influence your auto insurance rates can be eye-opening. From your driving record to personal factors and coverage options, understanding these factors can help you make informed decisions to lower your insurance costs. Let's delve into the top factors that impact your auto insurance quote in detail.

Factors Affecting Auto Insurance Quotes

When it comes to determining auto insurance quotes, several factors come into play that can significantly impact the cost of your coverage. Understanding these factors is crucial in making informed decisions when selecting an insurance policy.

Driving Record

Your driving record plays a crucial role in determining your auto insurance premiums. Insurance companies assess your driving history to gauge the level of risk you pose as a driver. A clean driving record with no accidents or traffic violations typically results in lower insurance rates, as it indicates that you are a safe and responsible driver.

On the other hand, a history of accidents, speeding tickets, or other infractions can lead to higher premiums, as it suggests a higher likelihood of future claims.

Type of Vehicle

The type of vehicle you drive also has a significant impact on your auto insurance costs. Insurance companies consider factors such as the make and model of your car, its age, safety features, and the likelihood of theft when calculating your premiums.

Generally, newer and more expensive vehicles will cost more to insure due to higher repair or replacement costs. Additionally, vehicles with advanced safety features may qualify for discounts on insurance premiums, as they are deemed less risky to insure.

Location and Crime Rate

Where you live can also affect your auto insurance premiums. Insurance companies take into account the location of your residence and the crime rate in that area when determining your rates. Urban areas with higher crime rates are associated with increased risks of theft, vandalism, and accidents, which can result in higher insurance premiums.

Conversely, living in a rural area with lower crime rates may lead to lower insurance costs.

Personal Factors and Their Impact

Age, gender, credit score, marital status, and occupation are some of the personal factors that can significantly impact your auto insurance rates. These factors are used by insurance companies to assess the level of risk you pose as a driver, which in turn determines the cost of your premiums.

Age and Gender

Younger drivers, especially teenagers, are statistically more likely to be involved in accidents compared to older, more experienced drivers. As a result, insurance companies tend to charge higher premiums for younger drivers. Gender also plays a role, with young male drivers typically facing higher insurance rates compared to young female drivers due to historical accident data.

Credit Score

Your credit score is another important personal factor that can influence your auto insurance quotes. Insurance companies often use credit scores as a way to assess your financial responsibility and reliability. A higher credit score may result in lower insurance premiums, as it is seen as an indicator of lower risk.

Marital Status and Occupation

Married individuals are generally considered to be more stable and responsible, leading to lower insurance rates compared to single individuals. Additionally, certain occupations may be perceived as less risky by insurance companies, resulting in lower premiums. For example, teachers may receive lower rates compared to professional race car drivers due to the differences in perceived risk.

Coverage Options and Their Influence

When it comes to auto insurance, the coverage options you choose can significantly impact your insurance quote. Understanding the different types of coverage available and how they influence your premiums is crucial in making an informed decision.

Types of Coverage Options

- Liability Coverage: This covers damages and injuries you are responsible for in an accident.

- Collision Coverage: This pays for damages to your vehicle in a collision, regardless of fault.

- Comprehensive Coverage: This covers damages to your vehicle from non-collision incidents, like theft or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are in an accident with a driver who lacks insurance or sufficient coverage.

Impact of Deductibles

- Choosing a higher deductible means you will pay more out of pocket in the event of a claim, but it can lower your insurance premiums.

- Lower deductibles typically result in higher premiums since the insurance company takes on more risk.

- Consider your financial situation and driving habits when deciding on a deductible amount.

Adding Extras like Roadside Assistance

- Adding extras like roadside assistance can increase your insurance premium, but it provides valuable services in case of emergencies.

- Consider whether the cost of adding extras outweighs the benefits they provide.

- Compare quotes with and without extra features to determine the best coverage option for your needs.

Ways to Lower Your Auto Insurance Quote

When it comes to reducing your auto insurance costs, there are several strategies you can implement to lower your quote. By taking advantage of potential discounts and demonstrating responsible driving habits, you can significantly decrease your premiums. Below are some effective ways to lower your auto insurance quote.

Bundling Policies for Potential Discounts

One of the most common ways to save on auto insurance is by bundling your policies with the same insurance provider. By combining your auto insurance with other policies such as home or renters insurance, you may qualify for a multi-policy discount.

This can lead to substantial savings on your overall insurance costs.

Benefits of Defensive Driving Courses on Insurance Rates

Another effective method to lower your auto insurance quote is by completing a defensive driving course. These courses teach you advanced driving skills and techniques to help you become a safer driver on the road. Many insurance companies offer discounts to drivers who have completed such courses, as they are considered lower risk and less likely to be involved in accidents.

Maintaining a Clean Driving Record to Reduce Premiums

One of the most impactful factors on your auto insurance rates is your driving record. By avoiding accidents, traffic violations, and DUI convictions, you can keep your record clean and demonstrate to insurance providers that you are a responsible driver.

A clean driving record can lead to lower premiums and potential discounts on your auto insurance policy.

Last Word

In conclusion, being aware of the various factors affecting your auto insurance quote is crucial in making sound financial decisions. By implementing strategies to lower your premiums and understanding how different elements play a role in determining your rates, you can navigate the world of auto insurance with confidence.

FAQ

How does my credit score impact my auto insurance rates?

Your credit score can significantly affect your auto insurance rates. Insurers often use it as a factor to determine your level of risk as a policyholder. Maintaining a good credit score can help you secure lower insurance premiums.

What are some ways to lower my auto insurance costs?

You can lower your auto insurance costs by bundling policies, taking defensive driving courses, and maintaining a clean driving record. These strategies can help qualify you for discounts and reduce your premiums.

Does my occupation impact my insurance premiums?

Yes, your occupation can influence your insurance premiums. Certain occupations may be considered higher risk by insurers, leading to higher premiums. It's important to disclose accurate information about your occupation when getting insurance quotes.