Exploring the essentials of What Information You Need Before Requesting an Auto Insurance Quote, this introduction sets the stage for an insightful discussion, blending informative details with a captivating narrative that draws readers in from the get-go.

This paragraph delves deeper into the intricacies of the topic, shedding light on key aspects that readers will find both engaging and thought-provoking.

Understanding Auto Insurance Coverage

When it comes to auto insurance, understanding the different types of coverage available is crucial in ensuring you have the right protection in place for your needs. Here, we will explore the various types of coverage and provide examples of when each type may be necessary.

Liability Coverage

Liability coverage is a fundamental part of any auto insurance policy as it helps cover costs associated with injuries or property damage you may cause to others in an accident. For example, if you are at fault in a collision that results in the other driver's medical bills or repairs to their vehicle, liability coverage can help cover these expenses.

Collision Coverage

Collision coverage is designed to help cover repair costs for your own vehicle in the event of an accident, regardless of fault. For instance, if you collide with another vehicle or object, collision coverage can assist in paying for the damages to your car.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision incidents such as theft, vandalism, or natural disasters. If your car is stolen or damaged by a falling tree branch, comprehensive coverage can help cover the costs of repairs or replacement.

Uninsured/Underinsured Motorist Coverage

This type of coverage is essential in protecting you if you are involved in an accident with a driver who does not have insurance or lacks sufficient coverage. Uninsured/underinsured motorist coverage can help cover your medical expenses and damages to your vehicle in such scenarios.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, covers medical expenses for you and your passengers regardless of fault in an accident. This coverage can also extend to lost wages and funeral expenses in some cases.

Choosing the Right Coverage

Selecting the appropriate coverage for your auto insurance policy is crucial in ensuring you are adequately protected in various situations. Consider factors such as your driving habits, the value of your vehicle, and your budget when choosing the right coverage options to meet your individual needs.

Factors Affecting Auto Insurance Quotes

When requesting auto insurance quotes, several factors play a significant role in determining the final cost of your premiums. Understanding these key factors can help individuals make informed decisions to potentially lower their insurance rates.

Age

Age is a crucial factor that influences auto insurance quotes. Younger drivers, especially teenagers, are typically charged higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older and more experienced drivers usually receive lower insurance rates.

Driving Record

Your driving record is another important factor that affects auto insurance quotes. Drivers with a history of accidents, traffic violations, or DUI convictions are considered high-risk and may face increased insurance premiums. Conversely, individuals with a clean driving record are often rewarded with lower rates.

Vehicle Type

The type of vehicle you drive also impacts your auto insurance quotes. High-performance cars, luxury vehicles, and sports cars are typically more expensive to insure due to their increased risk of theft, accidents, and costly repairs. On the other hand, family-friendly sedans and minivans are generally cheaper to insure.

Potential Ways to Lower Insurance Rates

- Maintain a clean driving record by following traffic laws and practicing safe driving habits.

- Consider taking a defensive driving course to improve your driving skills and potentially qualify for discounts.

- Choose a vehicle with safety features and a lower risk of theft to reduce insurance premiums.

- Opt for a higher deductible to lower your monthly premiums, but make sure you can afford the out-of-pocket costs in case of an accident.

- Bundling your auto insurance with other policies, such as homeowners or renters insurance, can often lead to discounts from insurance providers.

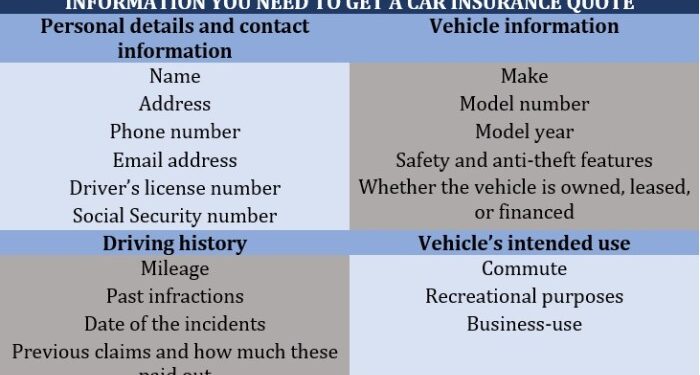

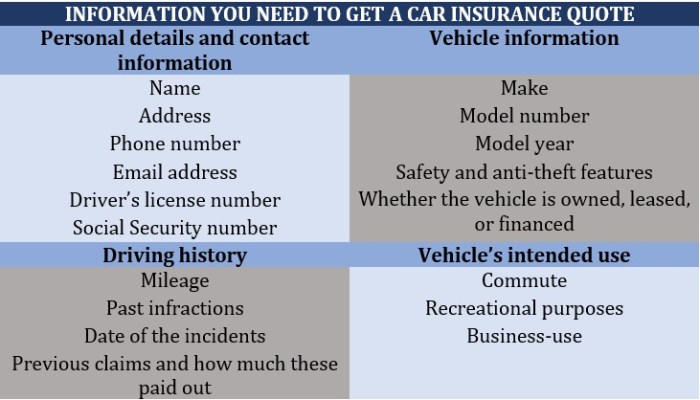

Necessary Personal Information

When requesting an auto insurance quote, you will need to provide specific personal information to the insurance provider. This information is crucial for the insurance provider to accurately assess the risk associated with insuring you and to determine the cost of your auto insurance policy.

Required Personal Information

- Your Personal Details (Name, Date of Birth, Address): Providing your personal details allows the insurance provider to identify you and determine where you live, which can impact your insurance rates based on factors like crime rates in your area.

- Driver's License Number: Your driver's license number helps the insurance provider verify your driving history and ensure accuracy in assessing your risk as a driver.

- Vehicle Information (Make, Model, Year, VIN): Details about your vehicle are essential for determining the appropriate coverage and pricing for your auto insurance policy.

- Driving History (Accidents, Tickets): Your driving history provides insight into your past behavior on the road, which can influence your insurance rates.

- Mileage: The number of miles you drive annually can impact your insurance rates, as higher mileage generally correlates with a higher risk of accidents.

- Insurance History: Information about your previous auto insurance coverage helps the insurance provider assess your risk and eligibility for certain discounts.

Researching Insurance Providers

Researching insurance providers before requesting a quote is crucial to ensure you are getting the best coverage for your needs. It allows you to compare different companies, their offerings, and their reputation in the market. Here are some factors to consider when selecting an insurance company and guidance on how to evaluate and compare insurance providers effectively.

Factors to Consider When Selecting an Insurance Company

- Customer Reviews: Check online reviews and ratings to get an idea of the customer experience with the insurance provider. Look for feedback on claim processing, customer service, and overall satisfaction.

- Financial Stability: Evaluate the financial strength of the insurance company by checking ratings from agencies like A.M. Best, Standard & Poor's, or Moody's. A financially stable company is more likely to honor claims and provide long-term coverage.

- Coverage Options: Consider the types of coverage the insurance provider offers and whether they align with your needs. Look for additional benefits or discounts that may be available.

- Premium Rates: Compare premium rates from different insurance providers to ensure you are getting competitive pricing for the coverage you need. Keep in mind that the cheapest option may not always be the best in terms of coverage and service.

Guidance on Evaluating and Comparing Insurance Providers

- Research Multiple Providers: Don't settle for the first insurance company you come across. Research multiple providers to compare their offerings and rates.

- Request Quotes: Reach out to different insurance companies to request quotes based on your specific needs. This will give you a better understanding of the coverage options and pricing available in the market.

- Ask Questions: Don't hesitate to ask questions about coverage, discounts, and claim processes. A reliable insurance provider will be transparent and willing to address your concerns.

- Check Licensing and Complaints: Verify that the insurance company is licensed to operate in your state and check for any complaints or disciplinary actions against them. This information can be found on your state's insurance department website.

Summary

Concluding our exploration, this final paragraph encapsulates the essence of the discussion, offering a compelling summary that leaves readers with a lasting impression.

Detailed FAQs

What personal information is needed when requesting an auto insurance quote?

You will typically need information such as your driver's license number, vehicle details, driving history, and contact information to get an accurate auto insurance quote.

How can I lower my insurance rates based on personal information?

By maintaining a clean driving record, opting for a higher deductible, and bundling insurance policies, you can potentially lower your insurance rates.

Why is researching insurance providers important?

Researching insurance providers allows you to compare coverage options, prices, and customer reviews to make an informed decision when choosing an insurance company.