What Is an Auto Insurance Quote and How Is It Calculated? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Introduction to Auto Insurance Quotes

An auto insurance quote is an estimate of how much it will cost for you to insure your vehicle based on various factors. It is essential to obtain auto insurance quotes to compare prices and coverage options from different insurance companies.

Factors Influencing Auto Insurance Quotes

Several factors can influence the cost of your auto insurance quote. Understanding these factors can help you make informed decisions when selecting an insurance policy.

- Your Driving Record: A history of accidents or traffic violations may result in higher insurance premiums.

- Type of Coverage: The type of coverage you choose, such as liability, comprehensive, or collision, will affect the cost of your quote.

- Vehicle Make and Model: The make, model, and age of your vehicle can impact your insurance rates.

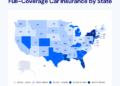

- Location: Where you live and park your car can also affect your insurance costs due to factors like crime rates and weather conditions.

- Age and Gender: Younger drivers and males tend to have higher insurance rates due to statistical risk factors.

- Credit Score: In some states, your credit score can influence your insurance premium.

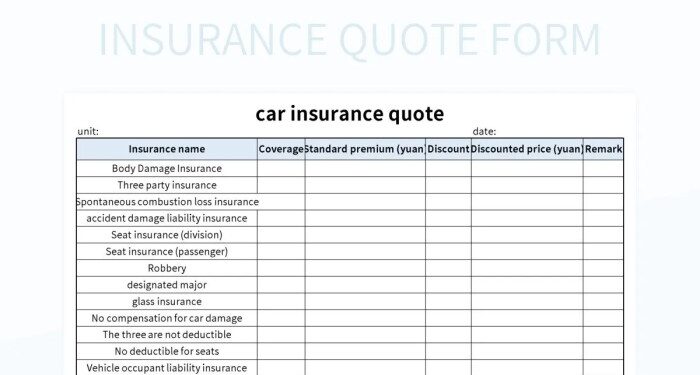

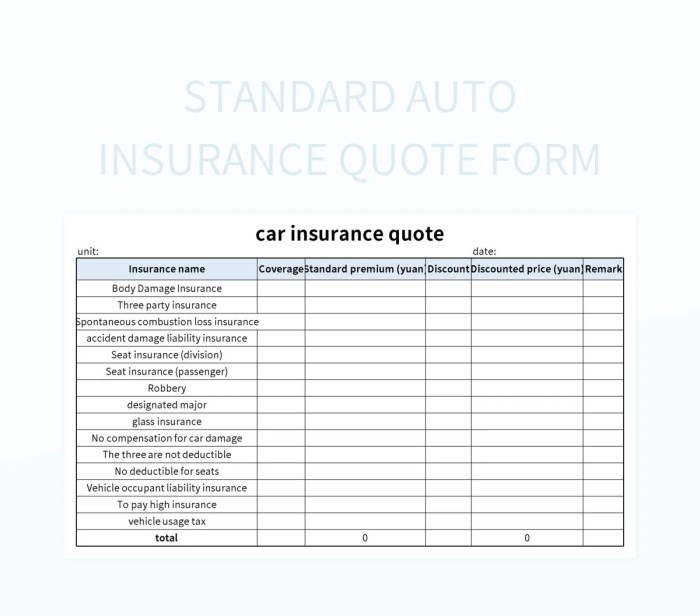

Components of an Auto Insurance Quote

When you receive an auto insurance quote, it typically consists of several key components that determine the cost and coverage of your policy. Understanding these elements is crucial in making an informed decision about your insurance needs.

Premium

The premium is the amount you pay for your insurance coverage. It is usually paid monthly, semi-annually, or annually, depending on the terms of your policy. The premium is calculated based on various factors such as your age, driving record, location, type of vehicle, and coverage limits.

Deductible

The deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and file a claim for $2,000 in damages, you would pay $500, and your insurance company would cover the remaining $1,500.

Choosing a higher deductible typically results in lower premiums but means you'll have to pay more upfront in the event of a claim.

Coverage Types

Auto insurance policies consist of different types of coverage, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. Each type of coverage offers protection for different scenarios, such as damage to your vehicle, medical expenses, and legal costs. The coverage types included in your quote will vary based on your needs and preferences.

Examples of Variation

For example, a younger driver with a history of accidents may receive a higher quote due to the increased risk associated with insuring them. On the other hand, an older driver with a clean driving record and a low-mileage vehicle may receive a lower quote.

Additionally, the coverage limits and deductible amounts can be adjusted to tailor the policy to individual circumstances.

Comparing Quotes

It's essential to compare auto insurance quotes from different providers to understand the variations in coverage and pricing. By obtaining multiple quotes, you can evaluate the different options available to you and choose the one that best meets your needs and budget.

Keep in mind that the cheapest quote may not always offer the most comprehensive coverage, so it's crucial to consider the value and protection provided by each policy.

How Auto Insurance Quotes Are Calculated

When it comes to determining auto insurance quotes, insurance companies take various factors into account to calculate a personalized rate for each individual

Key Factors Considered for Calculating Auto Insurance Quotes

- Driving History: Insurance companies typically review your driving record to evaluate your past behavior on the road. Any accidents, traffic violations, or claims can impact your insurance premium. A clean driving history usually results in lower rates.

- Personal Information: Details like age, gender, marital status, and even credit score can play a role in determining your insurance quote. Younger drivers, males, and individuals with a poor credit score may face higher premiums.

- Vehicle Details: The type of vehicle you drive, its age, make, model, and safety features can influence your insurance rate. Newer, safer cars often come with lower premiums compared to older models.

- Location: Where you live also matters. Urban areas with higher rates of accidents or vehicle theft may lead to higher insurance costs compared to rural areas.

- Coverage Options: The level of coverage you choose, such as liability, comprehensive, collision, and additional add-ons, will impact your insurance quote. More coverage typically means higher premiums.

Tips for Obtaining Accurate Auto Insurance Quotes

When seeking auto insurance quotes, it is crucial to provide precise information to ensure that the quotes you receive are accurate. Inaccurate information can lead to misleading quotes and potential issues when filing a claim. Here are some tips to help you obtain the most accurate auto insurance quotes possible.

Importance of Providing Accurate Information

When obtaining auto insurance quotes, it is essential to provide accurate information about yourself, your vehicle, and your driving history. Insurance companies use this information to assess your risk level and determine the cost of your policy. Failing to provide precise details can result in inaccurate quotes that may not reflect the actual cost of coverage.

Strategies for Getting Precise Quotes

- Double-check all information: Before submitting your details for a quote, ensure that all information provided is accurate and up to date. This includes details such as your driving record, vehicle information, and personal details.

- Be honest: It is important to be truthful when providing information for an auto insurance quote. Providing false information can lead to your policy being voided or claims denied in the future.

- Ask questions: If you are unsure about any details required for the quote, don't hesitate to ask the insurance provider for clarification. This will help ensure that you provide the correct information.

Comparing Quotes Effectively

When comparing auto insurance quotes, it is essential to look beyond the price and consider the coverage options and limits offered by each policy. Here are some tips to help you compare quotes effectively:

- Compare coverage options: Look at the types of coverage offered by each policy and ensure that they meet your needs.

- Review deductibles and limits: Pay attention to the deductibles and coverage limits of each policy to understand how much you will be responsible for in the event of a claim.

- Consider additional benefits: Some policies may offer additional benefits such as roadside assistance or rental car coverage. Take these into account when comparing quotes.

Final Summary

In conclusion, What Is an Auto Insurance Quote and How Is It Calculated? delves into the intricacies of auto insurance quotes, shedding light on the factors that influence pricing and coverage. It's a must-read for anyone looking to navigate the world of auto insurance with confidence.

Questions Often Asked

What factors influence auto insurance quotes?

Factors such as driving record, age, type of vehicle, and coverage options can all impact auto insurance quotes.

How are auto insurance quotes calculated?

Auto insurance quotes are calculated based on factors like personal information, driving history, and details about the vehicle being insured.

Why is it important to obtain auto insurance quotes?

Obtaining auto insurance quotes is crucial as it helps individuals compare coverage options and prices to find the best policy for their needs.