Delve into the world of auto insurance quotes and uncover the reasons behind the varying prices offered by different companies. This exploration promises to shed light on the intricate factors influencing your insurance costs, paving the way for a deeper understanding of this complex landscape.

As we navigate through the nuances of auto insurance pricing, we'll unravel the mysteries that lead to fluctuating quotes and provide valuable insights into this crucial aspect of financial planning.

Factors Affecting Auto Insurance Quotes Variation

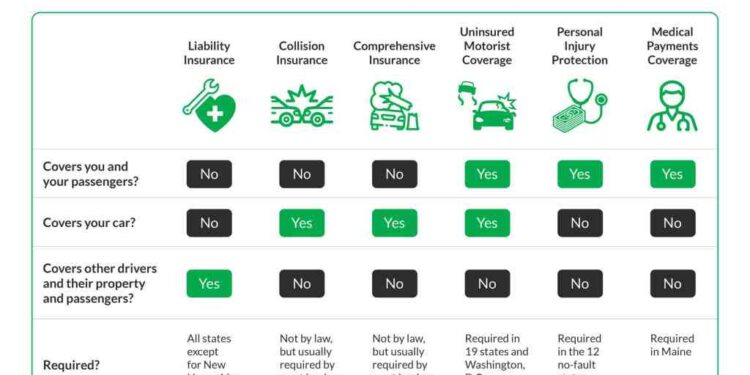

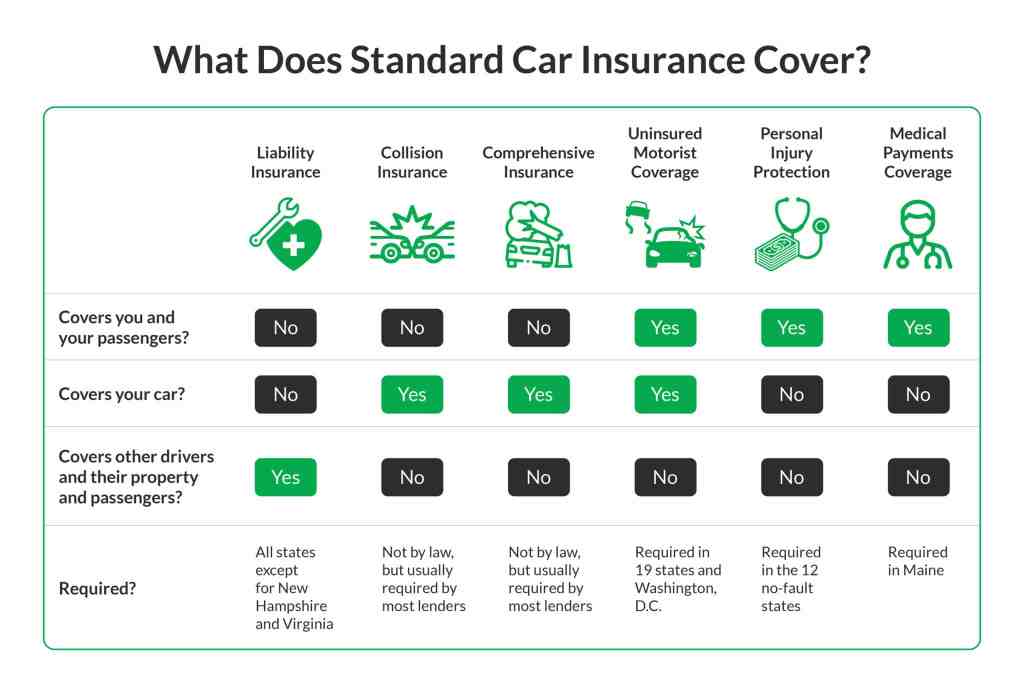

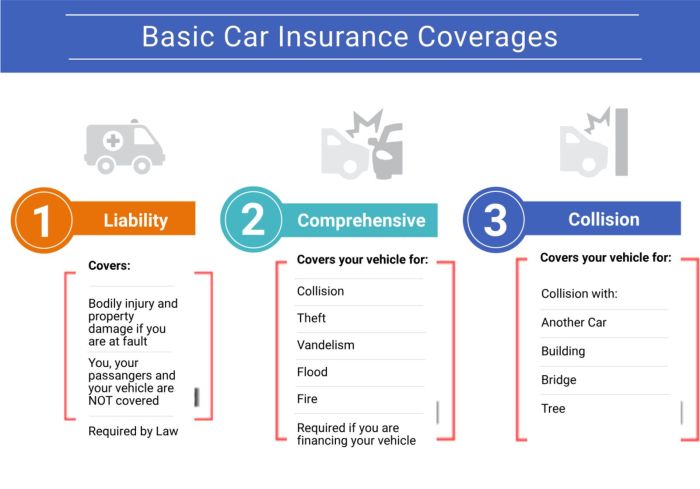

When obtaining auto insurance quotes, it is essential to understand the various factors that can lead to differences in pricing between insurance companies. These factors can range from personal details to the type of coverage chosen, all of which play a significant role in determining the final insurance premium.Age, gender, location, driving record, and the type of vehicle are some of the key factors that influence auto insurance quotes.

Younger drivers or individuals with a history of accidents may receive higher quotes due to the perceived higher risk they pose to insurance companies. Additionally, the location where the vehicle is primarily driven can impact the quote, with urban areas typically having higher rates than rural areas.

Coverage Limits and Deductibles

- Coverage limits refer to the maximum amount an insurance company will pay out for a claim. Higher coverage limits often result in higher premiums, as the insurance company is taking on more risk.

- Deductibles are the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible can lower the premium, but it also means more expenses in the event of a claim.

Optional Add-Ons

- Optional add-ons, such as roadside assistance or rental car coverage, can also impact the overall cost of insurance. While these add-ons provide additional benefits, they come with an extra cost that can vary between insurance companies.

- Some insurance companies may offer unique add-ons or discounts that others do not, leading to differences in pricing for the same level of coverage.

Data and Algorithms

In the world of auto insurance, data and algorithms play a crucial role in how insurance companies calculate quotes. By analyzing various individual risk factors and using statistical models, insurers can assess the likelihood of a claim and determine the appropriate premium to charge.

This process is not only complex but also highly personalized, leading to variations in quotes among different insurance providers.

Role of Technology in Pricing Process

Technology has revolutionized the insurance industry, particularly in the pricing process. Insurers now have access to vast amounts of data, allowing them to track trends, patterns, and behaviors that can impact the likelihood of a claim. By utilizing sophisticated algorithms, insurance companies can accurately predict risk levels for each individual policyholder, resulting in tailored auto insurance quotes.

This technological advancement ultimately leads to variations in quotes, as each insurer may weigh certain risk factors differently based on their algorithms and data analysis.

Competitive Landscape

The competitive landscape in the auto insurance industry plays a significant role in determining the pricing of auto insurance quotes. Insurance companies constantly strive to attract customers by offering competitive rates and differentiating themselves in the market

Positioning in the Market

- Insurance companies position themselves in the market based on factors such as their target customer demographics, coverage options, claims process efficiency, and overall customer service.

- Some insurers may focus on providing affordable rates to cater to budget-conscious customers, while others may emphasize comprehensive coverage and premium services for higher-end clients.

- Each company's unique positioning influences the rates they offer, as they adjust their pricing strategies to align with their target market's needs and preferences.

Competitive Strategies

- Insurance companies may adjust their pricing strategies to gain a competitive edge in the market. This could involve offering discounts for safe drivers, bundling policies, or introducing innovative products to attract specific customer segments.

- By analyzing market trends and consumer behavior, insurers can tailor their pricing to remain competitive while still maintaining profitability.

- The intense competition among insurance companies ultimately benefits consumers, as it leads to a wider range of options and competitive pricing in the auto insurance market.

Customer Service and Reputation

Customer service quality and reputation play a significant role in determining auto insurance quotes. Companies with a strong reputation for excellent customer service and claims handling tend to attract more customers and can offer competitive pricing based on their positive reputation.

Impact on Pricing

Companies that are known for providing exceptional customer service and efficiently handling claims are often perceived as more reliable and trustworthy. As a result, these companies may be able to offer lower insurance quotes to customers because they are seen as less risky to insure.

On the other hand, companies with a poor reputation for customer service may have to charge higher premiums to compensate for the increased risk associated with insuring their customers.

- Positive Reputation: Companies with a stellar reputation for customer satisfaction and claims handling may offer lower insurance quotes as they are perceived as less risky.

- Negative Reputation: Companies with a poor reputation may charge higher premiums to mitigate the risk associated with insuring their customers.

- Customer Reviews: Positive reviews and high ratings can lead to lower quotes from insurance providers, as they indicate a high level of customer satisfaction and trust in the company.

Last Word

In conclusion, the realm of auto insurance quotes is a multifaceted domain where numerous elements intertwine to shape the prices we encounter. By grasping the key factors explored in this discussion, you are better equipped to navigate the dynamic landscape of insurance offerings and make informed decisions that align with your needs and budget.

FAQ Explained

Why do auto insurance quotes vary between companies?

Auto insurance quotes differ between companies due to various factors such as individual risk profiles, coverage options, and competitive pricing strategies.

How do data and algorithms impact auto insurance pricing?

Insurers utilize data and algorithms to assess risk factors, calculate quotes, and determine the likelihood of claims, leading to varying prices among providers.

Can customer service quality affect auto insurance quotes?

Yes, a company's reputation for customer service and claims handling can influence insurance pricing, with positive reviews potentially impacting quotes.